Master Association foreclosed on a condo

First-ever association foreclosure at Edgewater Isle

Originally Posted: May 25, 2011

In an unprecedented action, Edgewater Isle has completed a foreclosure on a unit.

In an unprecedented action, Edgewater Isle has completed a foreclosure on a unit.

On April 26, 2011, the Master Association foreclosed on 2021 Vista Del Mar, a one-bedroom unit purchased by Andrew Limcaco and Jennifer Limcaco in 2005 for $450,000. Public records show that the purchase was 100% financed (meaning: the homeowners did not have a down payment) and that both North and Master associations pursued the homeowners who had not paid dues in several years.

Public documents were recorded as follows:

| Date | Activity | Amount |

|---|---|---|

| October 14, 2005 | Deed and Deed of Trust recorded (i.e., they purchased the condo) | |

| February 6, 2007 | Master Association records lien for unpaid HOA dues | $1,548 |

| April 9, 2007 | North Association records lien for unpaid HOA dues | $2,899 |

| May 29, 2007 | North Association records lien for unpaid HOA dues | $3,764 |

| August 16, 2007 | HOMEOWNERS FILE CHAPTER 7 BANKRUPTCY (All 2007 recorded HOA liens are wiped out in bankruptcy court) |

|

| July 8, 2008 | Master Association records lien for unpaid HOA dues | $1,754 |

| August 31, 2009 | Master Association records lien for unpaid HOA dues | $3,024 |

| March 24, 2011 | Master Association records lien for unpaid HOA dues | $8,952 |

| April 26, 2011 | Master Association receives Certificate of Foreclosure Sale | $8,325 |

| August 2, 2011 | Master Association receives Trustee's Deed Upon Sale |

During this same time, there are also other recordings of default not related to the homeowners association in addition to the Licmacos' bankruptcy filing.

Experts in this foreclosure process told us that during the 90-day period after the Certificate of Foreclosure Sale is issued, the Master Association cannot do anything with the property as the homeowners have the right of redemption (i.e., buy the property back). After 90 days, title will be issued in the Master Association's name, and the Master Association can evict the homeowners and sell or rent the unit as they decide. The mortgage remains the responsibility of the homeowners, and the mortgage holder can then foreclose on the Master Association to regain title of the property. The Master Association does not have a credit rating and likely will not care if the Association is foreclosed upon. But will it even get that far? Time will tell.

Certificate of foreclosure sale

Homeowner has a 90-day right of redemption

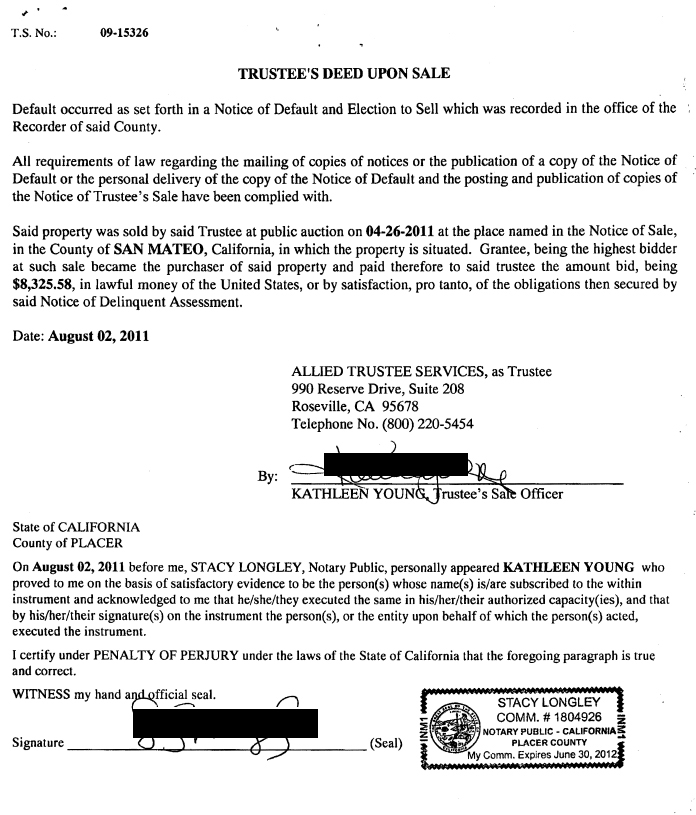

Deed upon sale

This document finalizes the transfer of title to the Edgewater Isle Master Association.

Homeowners: you now own this

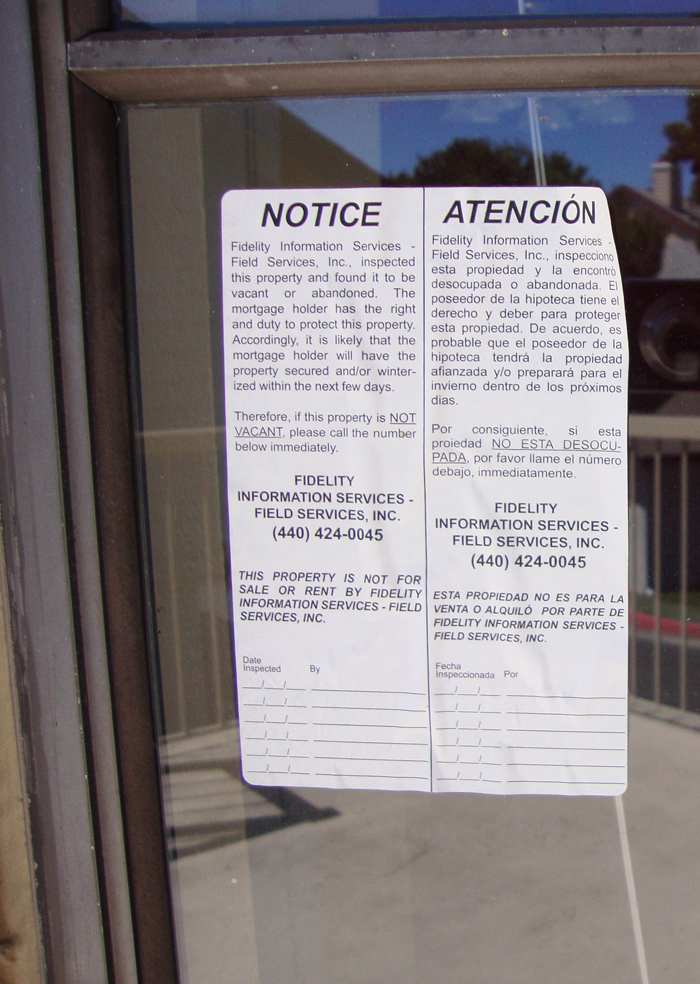

Each homeowner in the Master Association has an 1/416th interest in 2021 Vista Del Mar, complete with all sorts of "Notice of Default" and other related documents stuck and stapled to the door and windows.

Who's to blame?

In the bigger picture, there is a lot of blame to go around.

Andrew Limcaco and Jennifer Limcaco never had any equity: this condo was 100% financed. Prices have tumbled since the Limcacos bought this unit. Currently (May 2011) a 1 bedroom is listed for (short) sale for $260,000, which is a decline of 42% in value from what the homeowners here paid.

The boards hold responsibility in this mess for failing to control dues.

The banks hold responsibility in allowing these 100% financed deals.

And finally, these homeowners, Andrew Limcaco and Jennifer Limcaco, hold responsibility: to buy a condo and not make HOA dues payments FOR YEARS is irresponsible. Most who find themselves in an untenable financial problem would sell the condo and move on. Why didn't they?

UPDATE: August 22, 2011

The Edgewater Isle Master Association now has title to the condo. The Association can rent the property, probably on a month-to-month basis, and while awaiting for the condo's lender to foreclose on the Master Association to regain title. The lender will then sell the property. The unit is vacant, so an eviction proceeding is not necessary.

UPDATE: August 24, 2011

An article by Bloomberg discusses how some HOAs across the country are suing banks to force BANKS to foreclose on delinquent owners. Because banks frequently stall foreclosure proceedings (as has been the case at Edgewater Isle), it prolongs the time that HOAs go without receiving dues from that unit.

Banks often hold off on a foreclosure as long as they can to avoid paying dues, property taxes and occupancy costs, said John Ricked, chief executive officer of Association Dues Assurance Corp., a St. Clair Shores, Michigan, company that collects fees for community associations in 20 states HO-industry collection agency.

UPDATE: 7/20/2013

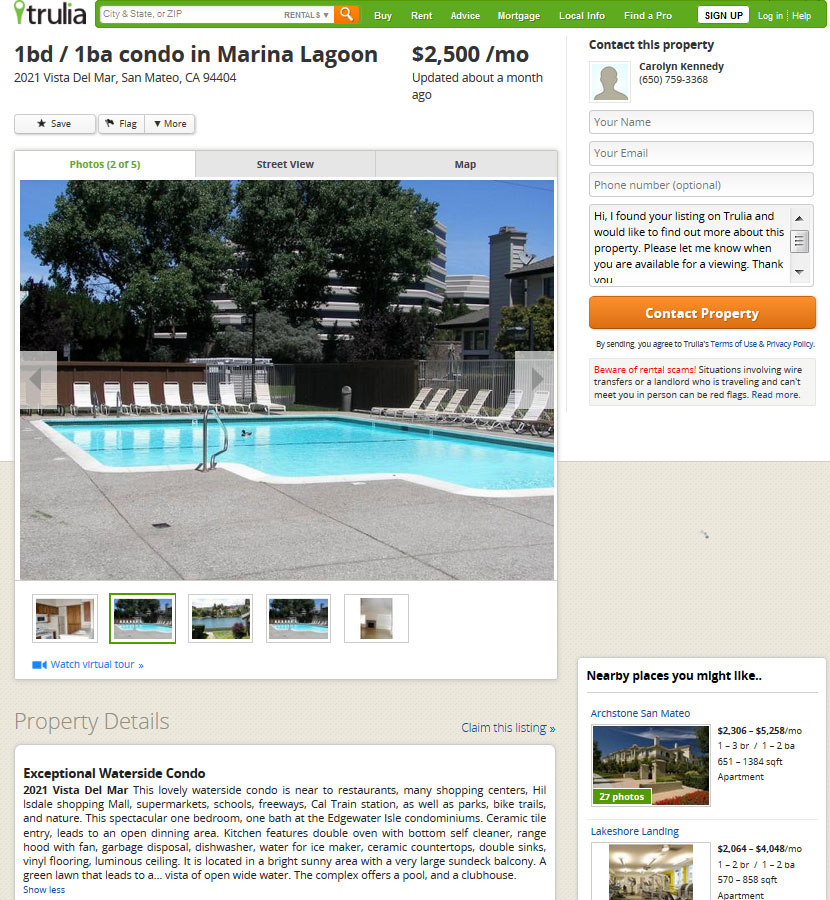

Last month (June 2013), the Master Association listed this condo for rent at $2,500. (And just for fun, let's count the typos and mis-capitalized and/or incorrect words and/or incomplete sentence and/or incorrect punctuation in red):

Exceptional Waterside Condo

2021 Vista Del Mar This lovely waterside condo is near to restaurants, many shopping centers, Hillsdale shopping Mall, supermarkets, schools, freeways, Cal Train station, as well as parks, bike trails, and nature. This spectacular one bedroom, one bath at the Edgewater Isle condominiums. Ceramic tile entry, leads to an open dinning area. Kitchen features double oven with bottom self cleaner, range hood with fan, garbage disposal, dishwasher, water for ice maker, ceramic countertops, double sinks, vinyl flooring, luminous ceiling. It is located in a bright sunny area with a very large sundeck balcony. A green lawn that leads to a vista of open wide water. The complex offers a pool, and a clubhouse.

A clubhouse? Hum..... where is it? Also... love the "double oven." No such thing in the photos. And a rental listing with someone who fails to write 8th-grade level English.

Master Association didn't pay dues

July 20, 2013

Two years ago, the Master Association foreclosed on a condo in the North. Since that time, the Master Association sat on the unit (i.e., left it vacant) while failing to pay dues to the North Association. Now, the Association has rented the unit, all while being the type of unpaying owner that the Master Association itself files small claims cases about.

Public records show that the Master Association foreclosed on a condo, 2021 Vista Del Mar, in April 2011 and took title to it in August 2011, while the Association was a suspended corporation. The Master Association failed to do anything with this condo for the last two years, perhaps because they were waiting for the condo's mortgage holder to foreclose on the condo as well.

Master Association won't pay late fees or interest on late dues

During the two years that the Master Association has owned this condo, the Master Association failed to pay North dues. When the Master finally caught up with its payments this past spring, the Master Association believed they did not have to pay late fees or interest that would be required of — demanded even — of any other owner. This, while the Master Association sues other owners and adds plenty of junk fees to their small claims cases yet believes the same rules don't apply to them.

The Master Association only recently (in the Spring of this year) paid the last two years of dues, but for some reason, the Master Association determined that it won't pay the late fees and interest of those unpaid dues. At the same time the Master Association sues other owners for the exact same thing.

Representatives from the North and Master Associations failed to respond to an email requesting comment.

Master Association sues previous owners for unpaid dues

September 24, 2013

The North Association filed a small claims case against the previous owners, Andrew Limcaco and Jennifer Limcaco, for unpaid dues of $5,000. The hearing is scheduled for November 13, 2013.

December 6, 2013

Judgment was entered for the Edgewater Isle North Association for $5,000 plus costs. Judgment against Jennifer Limcaco only: Andrew Limcaco was dropped from the case.

February 20, 2014

An abstract of judgment was filed against the Jennifer Limcaco on February 12, 2014, for the unpaid judgment.

Master Association sells the condo

June 19, 2019

The Master Association sold this unit in November 2016 for $570,000.

Contact

Contact